(Source: KRA PAYE GUIDE FOR EMPLOYERS, Section 7, Page 12)

Fringe Benefit Tax is a tax on loans provided to an employee, director or their relatives at an interest rate lower than the market interest rate.

FBT is a tax on the employer, not the employee:

Following amendment to the law by the 1998 Finance Act and introduction of “FRINGE BENEFIT TAX” which is payable by employers, the determination of the chargeable benefit is now in two categories i.e. for loans provided on or before 11th June, 1998 and loans provided after 11th June, 1998.

In case of loans provided after 11th June, 1998 or loan provided on or before 11th June, 1998 whose terms and conditions have changed after 11th June, 1998, the value of Fringe Benefit shall be the difference between the interest that would have been payable on the loan if calculated at the market interest rate and the actual interest paid.

Market Interest Rate:

Market Interest Rates are published on the KRA website every three months:

- Published here: KRA Public Notices

- Example: Oct to Dec 2022 Market Interest Rate Notice

The taxable value of Fringe Benefit is determined as follows:-

Example:

Employer’s loan amount – Kshs.3,000,000

• Interest charged to employee – 3%

• Market Interest rate for the month – 9%

Calculation of Fringe Benefit Tax:-

Fringe Benefit percentage (FBT) is: 9% – 3% = 6%

FBT for the Year: Kshs.3,000,000 x 6% = Kshs.180,000 per annum

FBT Per Month: Kshs.180,000 / 12 = Kshs.15,000 per month

FBT payable by employer is (30% of Monthly): Kshs. 15,000 x 30% = Kshs.4,500/- per month

NOTES:

• Fringe benefit is taxable at corporation rate of tax of 30% of the determined value of the benefit.

• Fringe benefit tax shall be charged on the total taxable value of Fringe benefit each month and the tax is payable before the 10th day of the following month in the same way as normal P.A.Y.E. remittance. Employers will therefore pool together all the Fringe benefits for the employees in each month.

• The provision of loans shall include a loan from an unregistered pension or provident fund.

• Fringe benefit tax charged prior to 1st January, 1999 is due and payable before 10th January, 1999.

• “Market Interest Rate” means the average 91 days Treasury Bill rate of interest for the previous quarter.

• The above provisions will continue to apply even after employee leaves employment as long as the loan remains un-paid.

• Fringe benefit tax is payable even where corporation tax is not due by the employer in question

• The provisions of the Act relating to fines, penalties, interest charged, objections and appeals shall apply to the fringe benefit tax.

How To Pay

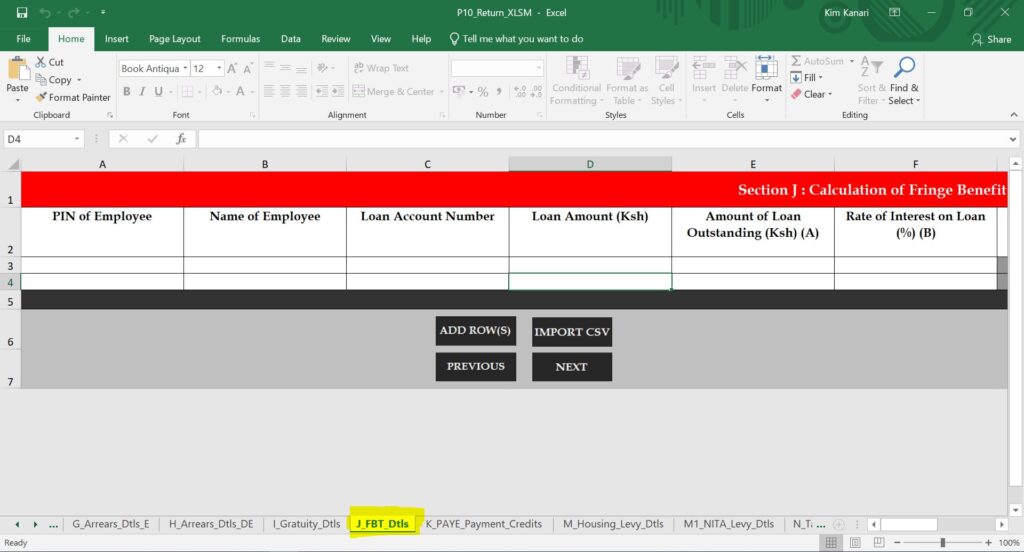

Add the FBT schedule for your organization to your monthly PAYE P10 return, on the FBT sheet is called “J_FBT_Dtls”. Then pay along with your PAYE.